north dakota sales tax exemption

Groceries are exempt from the North Dakota sales tax. UND Status within State Government.

Sales Tax Exemption Sd State Auditor

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making.

. University of North Dakota UEI Number. Remote sellers with no physical presence in North Dakota are required to collect state and local sales tax on taxable sales made into North Dakota unless they qualify for the small seller. How to use sales tax exemption certificates in North Dakota.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. North Dakota Office of State Tax Commissioner. North Dakota has several sales tax exemptions by industry including.

Ohio Form Example. Tax Exemption Documents University of North Dakota DUNS Number. North Dakota provides sales tax exemptions for equipment and materials used in manufacturing and other targeted industries.

No Sales Tax Exemption. You can download a. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement.

Generally churches can be granted exemptions from collecting and remitting sales tax if requested on sales at one-time events when the entire amount is expended for charitable or. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8. Carbon dioxide for enhanced recovery of oil and gas. A new or expanding plant may be exempt from sales and use tax.

North Dakota Form. Certain industries in North Dakota may qualify for a sales tax exemption. Agricultural commodity processing plant construction materials.

No Sales Tax Exemption Available. Copyright 2022 North Dakota Office of State Tax Commissioner 600 E. Signed by new owner with tax exemption and lienholder information if applicable and date of dissolution.

A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. Recipients of North Dakota tax incentives and exemptions must remain compliant with all state and local tax responsibilities and tax liens owed to the state or. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax.

The State Energy Program SEP promotes energy efficiency and conservation and is supported by financial and technical assistance through the US. 127 Bismarck ND 58505-0599 Main Number. Groceries are exempt from the North Dakota sales tax.

Form RW-EXM - Exemption Status for Royalty Withholding for Publicly Traded Partnership and Tax Exempt Organization 2022 Form RWT-1096 - Royalty Withholding Annual Return and. Agricultural Commodity Processing Plant Construction Materials.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

North Dakota Charitable Registration Harbor Compliance

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Form E1932 V10 Fillable Exemption Certificate

How To Use A North Dakota Resale Certificate Taxjar

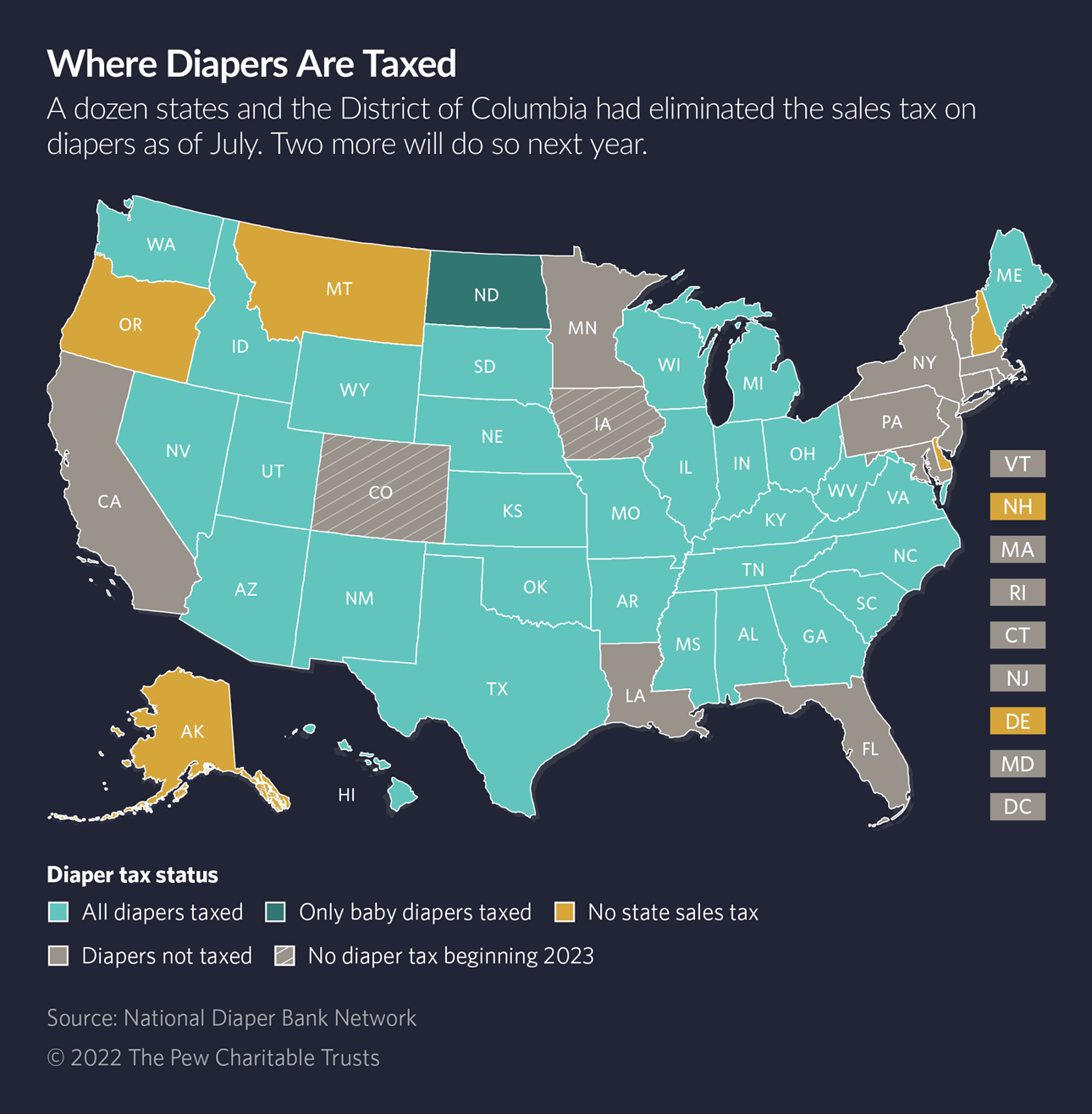

As Prices Rise The Push To End Diaper Taxes Grows Maryland Matters

Business Guide To Sales Tax In North Dakota

State Lodging Tax Requirements

Form Sfn 21854 Certificate Of Purchase Exempt Sales To A Person From Montana

North Dakota Cities Oppose Bill To Exempt Clothing From Sales Taxes Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

Printable South Dakota Sales Tax Exemption Certificates

Ag Producers Income Tax Management Program Morning Ag Clips

Farm Residence Exemption Cass County Nd

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation