maryland tax lien payment plan

Schedule a free initial consultation. Based On Circumstances You May Already Qualify For Tax Relief.

Tax Liens Background Checks Goodhire

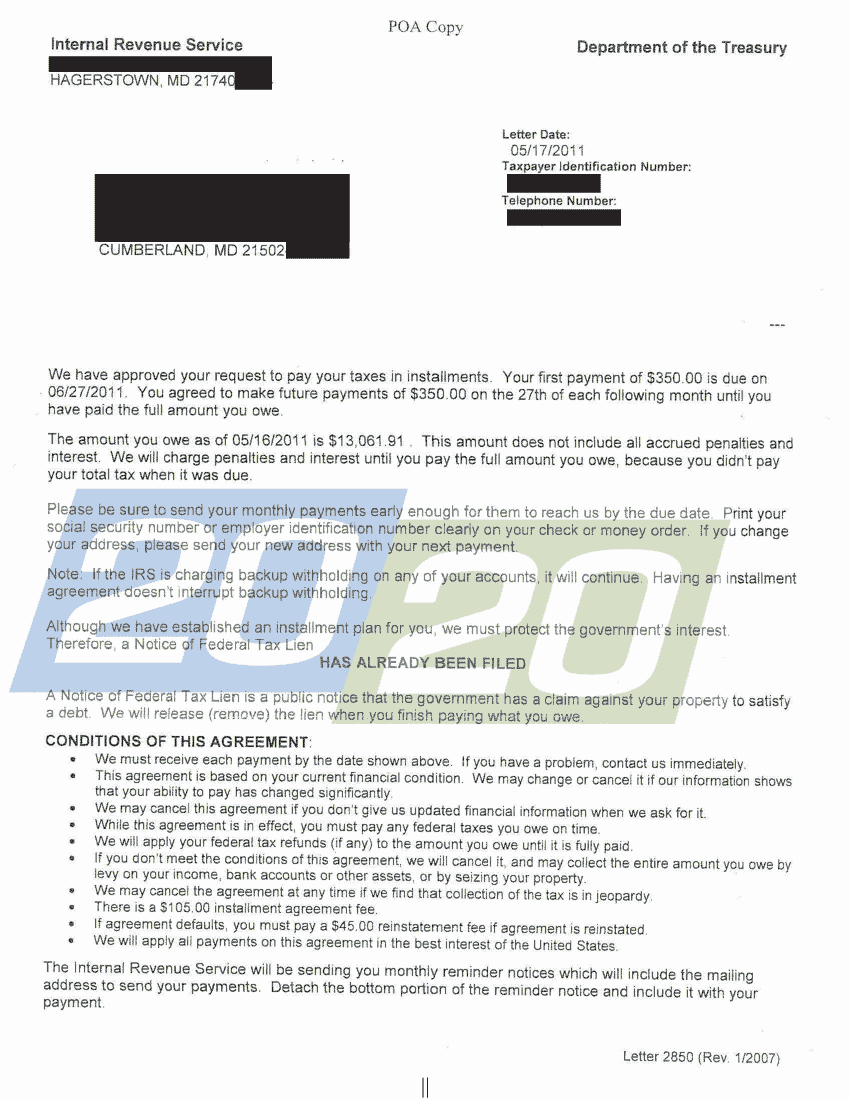

However the balance is subject to penalties and interest.

. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A. We are experienced tax professionals. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

This is an ongoing. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs. Check your Maryland tax liens.

We Solve Tax Problems Irs Taxes Tax Debt Debt Relief Programs 5 12 7 Notice Of Lien Preparation And. Dont Let that Lien Hold Back Your Financial Future. You may send your request by e-mail.

Select estimated personal income tax personal. However for longer-term tax payment plans the controller could file a tax lien. This electronic government service includes a serviceconvenience.

Alternative electronic check payment options are available through the office of the Comptroller of Maryland. Free Case Review Begin Online. You may use this service to set up an online payment agreement for your Maryland personal.

Get Your Options Today. If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov by calling. A tax lien may damage your credit score and can only be released when the back tax is paid in full.

Taxpayers who owe past-due state taxes may be able to qualify for a. Maryland tax lien payment plan. For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax.

Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. Durations of 36 to 60 months are possible. Ad Safe and reliable tax resolution services.

A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. For business tax liabilities call 410-767-1601. Repayment terms can vary.

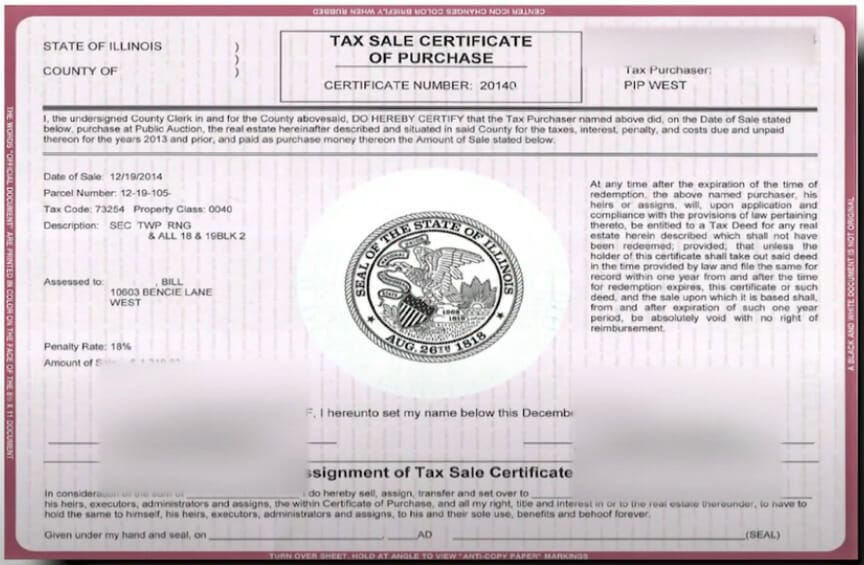

Trusted Methods Excellent Tax Team. Ad Real Estate Tax Liens Yield 18-36 Interest Or Possible Ownership. The IRS will demand most taxpayers to repay.

A tax lien can be linked to all of the taxpayers assets as well as property acquired in the future. Your request may also be sent by fax at 410-333-7745. Tax Lien Certificates Yield Great Returns Possible Home Ownership.

Get the Help You Need from Top Tax Relief Companies. Durations of 36 to 60 months are possible. Based On Circumstances You May Already Qualify For Tax Relief.

You can apply for a Maryland state tax payment plan by indicating that. When you respond to your state tax bill you may apply for a Maryland state tax payment plan by stating that you require one. Maryland tax lien payment plan.

The case began with a Montgomery County man Kenneth R. If the monthly payments on your tax. In order to initiate a payment plan you need to make an initial down payment on each.

Ad See If You Qualify For IRS Fresh Start Program. You can file your request online. Ad See If You Qualify For IRS Fresh Start Program.

Ad You Dont Have to Face the IRS Alone. Get a 20 discount - mention promo code. Ad Affordable Reliable.

A Maryland tax payment plan allows taxpayers to make monthly payments until the debt is met. Your Rights Regarding Appeal. Maryland tax lien payment plan Tuesday April 5 2022 Edit.

Free Case Review Begin Online.

Federal Tax Lien What Do You Do With Irs Tax Lien Delia Tax Attorneys

5 12 3 Lien Release And Related Topics Internal Revenue Service

The Essential List Of Tax Lien Certificate States

Irs Notice Cp503 Second Reminder For Unpaid Taxes H R Block

Maryland Tax Lien Online Auction Review Commercial Homes Land Youtube

20 Payment Plan Template Free Simple Template Design

5 12 3 Lien Release And Related Topics Internal Revenue Service

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Tax Liens And Your Credit Report Lexington Law

Maryland Comptroller And Irs Provide Tax Collection Relief In Response To Covid 19 Stein Sperling

Irs Accepts Installment Agreement In Cumberland Md 20 20 Tax Resolution

Free Federal Tax Lien Search Searchquarry Com

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Irs Letter 1038 Response To Inquiries About Release Of Federal Tax Lien H R Block

How To Avoid A Maryland State Tax Lien

Irs Notices Form 668 Y C Understand Form 668 Y C Lien Notification